what is fsa health care vs hsa

For 2021 you can contribute up to 2750 to a. HSA vs FSA.

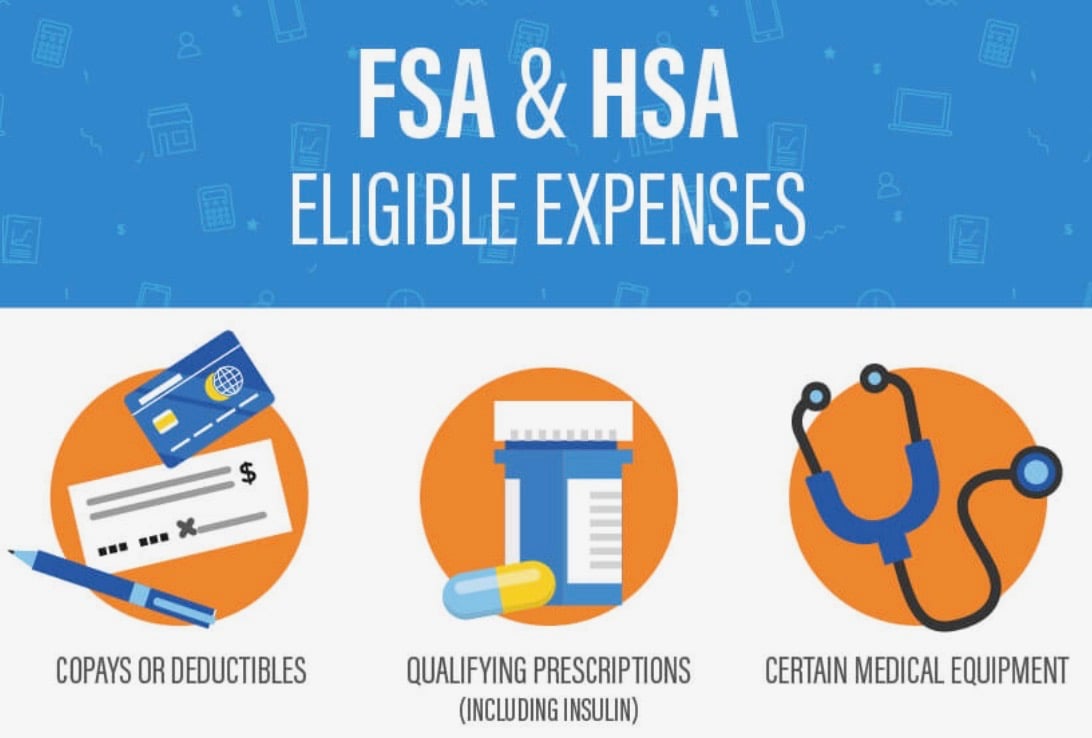

An employee who has an HSA or FSA contributes pre-tax dollars to their understanding reducing their taxable income.

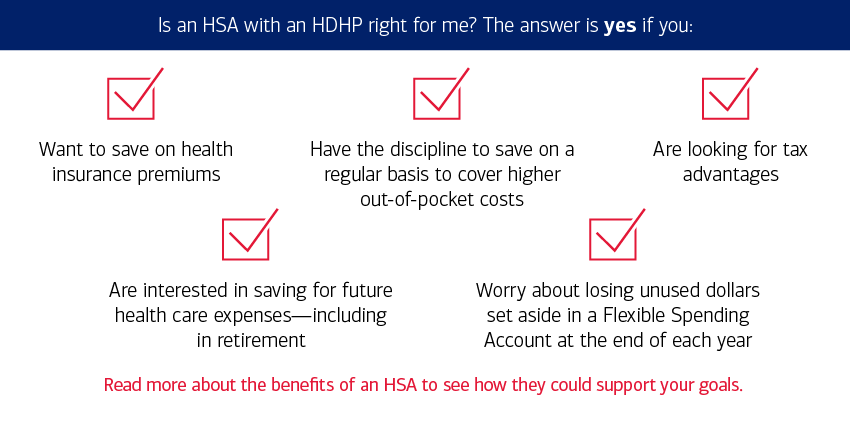

. Health 9 days ago Here is a breakdown of how an FSA and HSA differ. In most cases you forfeit your FSA savings if you dont use them in a given year. An HSA and FSA are both tax-advantaged accounts that let you stash your own money away for future health care costs.

What If You Also Have an HSA. With an HSA you have to have an HDHP. What is a Flexible Spending Account FSA.

While an FSA is sponsored by an employer an HSA or health savings account can either by set up through an employer or by an individual. Unlike with an FSA the account balance on your HSA rolls over from one year to the next. FSAs and HSAs are pre-tax accounts you can use to pay for healthcare related expenses.

Workers can utilize their account funds to insure out-of-pocket medical. If you have an HSA-eligible health insurance plan you can set aside pretax dollars in an HSA to pay for qualifying medical. A health savings account HSA is similar to an FSA.

In the 1970s the IRS created the Flexible Spending Account FSA to allow employees to pay pre-tax dollars for medical expenses and dependent care expenses that are. One of the main differences between an HSA and an FSA is what kind of health insurance plan you have to have. But HSAs dont have.

What is an HSA. Two types of accounts can save you money on those out-of-pocket costs such as deductibles and co-payments. A Flexible Spending Account FSA is a health care savings account that also lets you set.

A Health Savings Account HSA or a Flexible Spending Account. The minimum deductible to qualify is 1400 for individual plans or 2800 for family. Like FSAs Health Savings Accounts HSAs offer tax- advantages for healthcare expenses.

Whats the difference between a flexible spending account and a health savings account. If you are self-employed you can contribute to HSA. You can open an HSA or FSA at.

A high-deductible health plan HDHP is required. A Health Savings Account or HSA is an account often offered by employers or to individuals when they elect a high deductible health plan or HDHP. An FSA allows employees to set aside pre-tax money for certain health care and dependent care expenses not covered by insurance.

To open an HSA though you must first be enrolled in. The account owner is the employee.

Hsa Vs Fsa How Does Your Health Plan Affect Your Taxes

Fsa Vs Hra Vs Hsa An Explanation With Comparison Chart

Hsa Vs Fsa What Is The Difference Between Them Aetna

Explained Fsa And Hsa For Concierge Medicine

Open An Hsa Or Fsa Healthcare Savings Visa

Comparing Hsa Fsa And Hra Plans

:max_bytes(150000):strip_icc()/hra-vs-hsa-5190731_final-eec8d019c0a545009e049f4a96861d85.png)

Health Reimbursement Arrange Vs Health Savings Acct

Hsa Vs Fsa What Is The Difference The Healthcare Hustlers

Hsa Vs Fsa Which One Should You Get District Capital

Hsa Vs Fsa How The Two Accounts Stack Up Starship

How To Decide Between An Fsa And An Hsa Gobankingrates

Hsa And Fsa University Of Colorado

What S The Difference Between An Fsa And An Hsa First Dollar

Hsa Vs Health Care Fsa Which Is Better For You And Your Employees Insperity

What S The Difference Between An Fsa And Hsa Forbes Advisor